How to Invest in 2021: The Simplest Way To Ensure Profits

There are many ways to invest, but the simplest and quickest way to start investing is through the stock market. Below, I lay out a simple strategy that anyone can use to begin investing.

However, simple does not equal easy. Consistency and dedication are key.

This strategy is not a get rich quick scheme and no one should look at the stock market in that light. The fastest most sure-fire ways to make huge returns are through real estate and or opening your own business. Unfortunately, those require more capital, time, and risk tolerance.

The majority of people need a safe and simple strategy to start investing.

The Simple Answer Below: Index Funds and ETFs

Index Funds and ETFs are like baskets of stocks, and each basket tracks a particular equity index, such as the S&P 500. A “Total Market” index fund would produce similar if not exact results to the entire United States stock market.

The simplest way an investor can ensure they make profits from investing in the stock market is by: budgeting money each month to purchase shares of a total market or S&P 500 index fund or ETF, and continuing this practice for years to come. Start with a manageable amount of money and increase it whenever possible.

Why Index Funds?

The Little Book of Common Sense Investing by John C. Bogle, creator of the first index fund, founder, and former chairman of the Vanguard Group says, “A low-cost all-market fund, then, is guaranteed to outpace over time the returns earned by equity investors as a group. Once you recognize this fact, you can see that the index fund is guaranteed to win not only over time, but every year, and every month and week, even every minute of the day. (Bogle, 2017, pg. 31).”

Index funds help the investor follow the principal habits for building wealth:

- Appreciation

- Diversification

- Low costs

- Dividend income

- Compound Interest

Appreciation is the increase in the value of an asset over time. Take a glance at this chart from investing.com.

The S&P 500 (which represents the U.S stock market) has steadily increased over the past century, with occasional drops followed by new highs.

Over the past 60 years, the S&P 500 has returned 8% on average. By comparison, the average savings account interest rate for 2020 was only .05%. You can invest in an index fund or ETF that tracks the S&P 500, thereby guaranteeing your fair share of those average returns.

Diversification is important because you don’t want all your eggs in one basket. If you only invest in a couple of stocks and all their prices plummet, you’ll lose all your money. When you invest in an index fund, your money is invested in hundreds of stocks across the market and well-diversified.

Lower costs is a concept everyone is familiar with. However, most people don’t realize the effect that mutual fund and financial advisor fees have on their returns over time. Investors can buy into index funds with the lowest possible costs, leaving them with more profits.

Dividend income is money paid regularly to an investor per share by a company. Index funds are required to pass the dividend earnings on to the investors, and most funds give the option to reinvest that income. Dividend reinvestment plans (DRIPs) boost investors’ returns and increase the potency of compounding.

Compound interest is the mathematical effect where an investment earns gains on its previously earned gains. However, it will not work if the investor withdraws some or all of their money during the lifetime of their investment.

“Compounding interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t, pays it” — Albert Einstein.

Therefore, an investor that follows this simple strategy should plan to hold their investment for a specified amount of time and refrain from withdrawing money if they wish to use compounding interest to their advantage.

How does someone invest in index funds?

An investor needs to open a brokerage account to invest in index funds and ETFs.

Many stock brokerages offer user-friendly apps and provide excellent customer service to enable you to invest on your own. Fidelity, Vanguard, E-trade, Charles Schwab, and Robinhood are examples of brokerages. It is up to the individual investor to review different brokerages and decide for themselves which they want to use.

Most brokerages offer their own total market or S&P 500 index funds. An investor just needs to search for the correct ticker symbol.

For example: if you have Fidelity, Google search “Fidelity total market index fund,” and FSKAX will come up. That will be the fund you buy shares in. This process is easier with fractional shares investing because it allows you to select the dollar amount you wish to spend rather than requiring you to buy a full share.

If you have Robinhood, you’ll need to buy shares of ETFs because Robinhood does not hold index funds. The first results after Google searching “Robinhood total market ETFs” will show you VTI, which is Vanguard’s Total Stock Market ETF.

All the investor would need to do is:

- Budget a lump sum of money each month to use

- Transfer that lump sum from their bank account to their brokerage account

- Manually purchase that dollar amount of shares in the index fund/ETF using their brokerage app/website

- Adjust the monthly contribution as income or expenses change.

What does the end goal look like?

Before you start investing your money, you should create a plan based on your goals. Articulate what the goal is and what will be done to reach it.

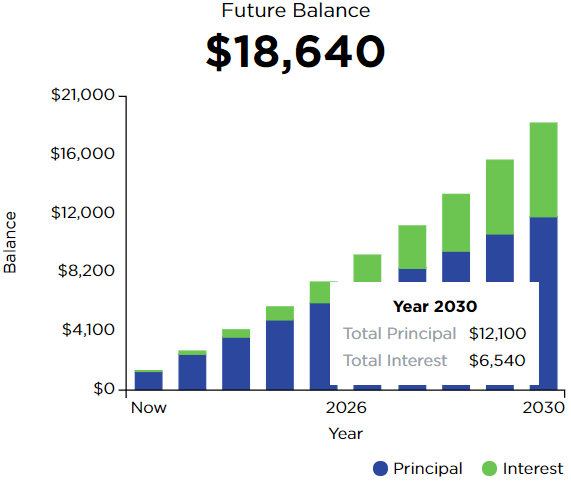

Following the basic principles in this article and using a compound interest calculator, we can compare the future value of hypothetical investment scenarios using an 8% return because that is the average from the S&P 500.

Investor A: Invests $100 every month for 10 years at 8% return.

Investor B: Invests $100 every month for 40 years at 8% return.

Investor C: Invests $500 every month for 40 years at 8% return.

The benefits of compounding interest are visible in these scenarios. The investor who contributed the most each month and held their investment the longest benefited the most.

Regardless, each investor benefited from this simple strategy. The question each investor should ask is: how much money are they trying to make? A few thousand or a million?

Each outcome is possible but reaching higher values takes larger contributions and above all: more time.

As Warren Buffet once said,

“Time in the market beats market timing every time.”

The sooner you can start investing any amount and the longer you can maintain your contribution the more effective your growth will be.

Other Considerations

Prerequisites Before Investing

Before someone starts investing they should have a couple of things marked off their to-do list:

- Have an emergency savings fund (at least $1,000 and up to 3–6 months of expenses).

- Pay off or have a plan implemented to pay off high-interest debt (credit cards, auto, or student loans).

- Read books on investing (recommended: The Little Book of Common Sense Investing by John C. Bogle).

- Start with an employer-sponsored retirement account.

Retirement Accounts

You can open a basic brokerage account and perform everything listed above. However, if you’d like to make even more money by avoiding taxes, you should use a retirement account like an IRA or Roth IRA.

Related: Why Roth IRAs Make Sense for Millennials

If an investor has an employee retirement account such as a 401k, 403b, or TSP, they should focus on that before opening a separate brokerage account. Employee retirement accounts follow the same principles in this article by investing your money in low-cost index funds. Employee retirement accounts are also tax-advantaged like IRA’s, allow higher maximum contributions, and many times your employer will match your contributions up to a certain percent (free money)!

Trading versus Investing

Investing in stocks can be differentiated from stock trading. Investing involves long term growth and holding onto stocks to utilize the different forms of return (appreciation, dividends, and compounding). Trading stocks involves short-term holds, consistent analysis, and much greater risk.

Everyone should be investing, but not everyone needs to be trading.

Investing in Single Stocks

There is nothing wrong with wanting to invest in one specific company. However, the strategies are different. Most investors should use index funds as the bedrock of their portfolios and then invest in single stocks as an additional form of investment.

Read: “Invest like Warren Buffet” by Matthew R. Kratter for a short and easy explanation of how to approach buying individual stocks.

Financial Advisors

You do not require a financial advisor to invest in the stock market. However, if an investor needs serious help or does not want to control their investments, the advisor’s fee may be worth it. Financial advisors provide a lot of value and can be life-changing to those who need help.

Other Investments

Investing in the stock market is only one way to invest your money. Real estate, peer to peer lending, and starting a business are also great avenues for investing. However, there is more risk, capital, and knowledge needed to find success with those options.

Conclusion

The basic principles of the strategy laid out in this article are:

- Invest in low-cost, total-market/S&P 500, index funds or ETFs

- Continue adding money to your pot at a scheduled time

- Refrain from withdrawing your money before your goal is reached

The only way for an investor to lose with this strategy is if the entire U.S. stock market crumbled and never rebounded — and if that happens we’ll probably have much worse problems to deal with than what our stocks look like.

This strategy is meant for those who want to start investing but are hesitant due to a lack of knowledge or experience, and need an easy way to start. Investing seems like a gamble to many people and they don’t want to make the wrong bet.

To them I say:

It is easier to bet that the entire United States stock market will have increased in value over the next 30 years than it is to consistently bet on a single stock increasing tomorrow morning or a year from now. So, bet on the entire U.S. stock market by investing in a total-market index fund.

This information is purely educational. Should you need further instruction, seek the guidance and services of a certified financial advisor. Past performance of stocks is not an indicator of future performance, there is always a risk when investing.